Non-cystic Fibrosis Bronchiectasis Market Ready to Shift Gears with the Entry of First DPP1 Blocker | DelveInsight

Insmed’s BRINSUPRI (brensocatib) has reached a significant regulatory milestone, earning FDA approval as the first-ever therapy for non-cystic fibrosis bronchiectasis and the first drug targeting DPP1. As the only available treatment in the non-cystic fibrosis bronchiectasis market, this represents both a scientific breakthrough and a pivotal shift in a market long defined by high unmet medical needs.

New York, USA, Aug. 25, 2025 (GLOBE NEWSWIRE) -- Non-cystic Fibrosis Bronchiectasis Market Ready to Shift Gears with the Entry of First DPP1 Blocker | DelveInsight

Insmed’s BRINSUPRI (brensocatib) has reached a significant regulatory milestone, earning FDA approval as the first-ever therapy for non-cystic fibrosis bronchiectasis and the first drug targeting DPP1. As the only available treatment in the non-cystic fibrosis bronchiectasis market, this represents both a scientific breakthrough and a pivotal shift in a market long defined by high unmet medical needs.

DelveInsight’s Non-cystic Fibrosis Bronchiectasis Market Report 2034 includes a comprehensive understanding of current treatment practices, emerging non-cystic fibrosis bronchiectasis drugs, market share of individual therapies, and current and forecasted non-cystic fibrosis bronchiectasis market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Non-cystic Fibrosis Bronchiectasis Market Report

- In August 2025, Insmed Incorporated revealed that the FDA had approved BRINSUPRI (brensocatib 10 mg and 25 mg tablets), a first-in-class, once-daily oral therapy for treating NCFB in adults and children aged 12 and above.

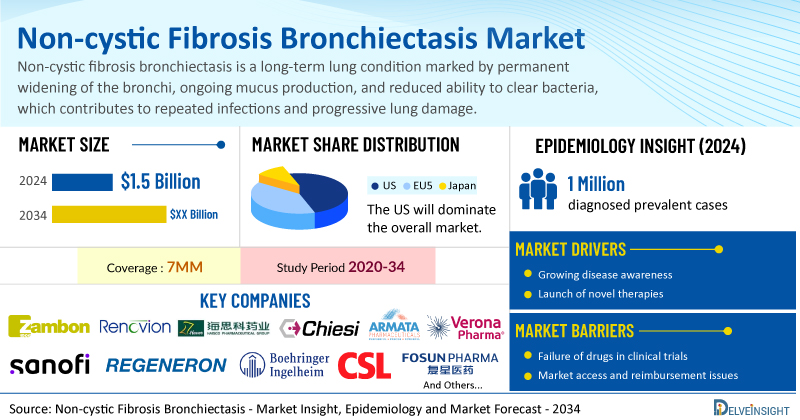

- According to DelveInsight’s analysis, the total market size for NCFB across the key geographies, such as the US, EU4, the UK, and Japan, was valued at USD 1.5 billion in 2024.

- The US non-cystic fibrosis bronchiectasis market is expected to grow at a CAGR of 11.7% during the study period (2020–2034).

- The United States accounts for the largest market size of NCFB, in comparison to EU4 (Germany, Italy, France, and Spain), the UK, and Japan.

- DelveInsight's epidemiology model estimates that there were ~1 million diagnosed prevalent cases of NCFB in the 7MM in 2024, which is expected to increase throughout the forecast period (2025–2034).

- Key non-cystic fibrosis bronchiectasis companies, including Zambon, Renovion, Haisco Pharmaceutical Group, Chiesi Farmaceutici S.p.A, Armata Pharmaceuticals, Verona Pharma, Sanofi, Regeneron Pharmaceuticals, Boehringer Ingelheim, Chiesi Farmaceutici S.p.A., CSL, Fosun Pharma, Expedition Therapeutics, Melodia Therapeutics, Alivexis, and others, are actively working on innovative non-cystic fibrosis bronchiectasis drugs.

- Some of the key non-cystic fibrosis bronchiectasis therapies in the clinical trials include Inhaled Colistimethate Sodium (CMS I-neb), ARINA-1 (RVN-301), HSK31858, AP-PA02, Ensifentrine (Nebulizer), Itepekimab, BI 1291583, CHF 6333, CSL787, XH-S004, MDI-0151, and others. These novel NCFB therapies are anticipated to enter the non-cystic fibrosis bronchiectasis market in the forecast period and are expected to change the market.

Discover which NCFB medications are expected to grab the market share @ Non-cystic Fibrosis Bronchiectasis Market Report

Key Factors Driving the Non-Cystic Fibrosis Bronchiectasis Market

Launch of Insmed’s BRINSUPRI

Insmed’s BRINSUPRI (brensocatib) has achieved a significant regulatory milestone, becoming the first FDA-approved DPP inhibitor and the first therapy authorized explicitly for NCFB. As the only treatment developed exclusively for this condition, its approval marks a significant scientific advancement, addressing a market with long-standing unmet needs. BRINSUPRI introduces a novel mechanism that targets the underlying inflammation in NCFB, offering patients a new therapeutic option.

Growing Non-cystic Fibrosis Bronchiectasis Diagnosed Patient Pool

Reported prevalence estimates and meta-analyses show bronchiectasis is more common than previously thought and rises steeply with age; improved imaging and awareness drive higher diagnosis rates, expanding the addressable non-cystic fibrosis bronchiectasis market. Around 390K individuals in the US have been diagnosed with NCFB in 2024, with millions more believed to be affected by the condition worldwide. This number is expected to cross 470K by 2034.

Non-cystic Fibrosis Bronchiectasis Competitive Landscape

With BRINSUPRI’s approval, competition to secure a strong foothold in the NCFB market has intensified. Key NCFB companies, including Boehringer Ingelheim [Verducatib (BI 1291583); Bronchiectasis], Fosun Pharma/Expedition Therapeutics (XH-S004; NCFB, COPD), Haisco Pharmaceutical Group/Chiesi (HSK31858; NCFB, Asthma), and Melodia Therapeutics/Alivexis (MDI-0151, still in preclinical development but showing promise in ANCA-associated vasculitis, bronchiectasis, COPD, and other conditions), are advancing their DPP1 inhibitor programs, seeking to redefine the treatment landscape.

Other Classes of Therapies in NCFB Clinical Trials

In addition to DPP1 inhibitors like BRINSUPRI, which have shown promise in treating NCFB by targeting neutrophilic inflammation, research is exploring other classes of inhibitors, including cell membrane modulators (CMS I-neb; Zambon), immunomodulators (ARINA-1; Renovion), and others, to address this condition.

How will the Launch of BRINSUPRI Impact the NCFB Market?

As the first DPP-1 inhibitor in respiratory care, BRINSUPRI’s distinct mechanism and first-to-market position could establish it as a standard of care for NCFB. Given its differentiated profile, Insmed is likely to commercialize the drug independently and has already initiated pre-launch activities. For example, the company recently offered 7.81 million shares at $96 each to raise approximately $750 million to support commercial preparations. Following FDA approval, Insmed’s stock rose around 15%, with a single-day gain of 8% on the approval day.

Submissions to the EMA and MHRA, with launches expected in 2026, highlight Insmed’s strong global commercialization strategy. Early regulatory progress combined with a first-mover advantage is expected to drive rapid international uptake and significant revenue growth, positioning BRINSUPRI as a potential multi-billion-dollar franchise. The absence of alternative approved therapies supports pricing power and high returns. Insmed is also investigating BRINSUPRI for other indications, including hidradenitis suppurativa and chronic rhinosinusitis without nasal polyps, both in mid-stage clinical development.

The BRINSUPRI market outlook appears highly promising as it pioneers treatment in this uncharted indication with high unmet needs. DelveInsight estimates that this drug is a potential blockbuster with peak BRINSUPRI market sales expected to cross ~USD 5 billion.

Learn more about the BRINSUPRI market potential @ BRINSUPRI for Non-cystic Fibrosis Bronchiectasis Treatment

DPP1 Inhibitors vs Bronchodilator-driven Therapies in NCFB Market

Currently, the non-cystic fibrosis bronchiectasis market is primarily driven by bronchodilators, but the launch of Insmed’s BRINSUPRI has opened a new avenue in the non-cystic fibrosis bronchiectasis market. With the launch of BRINSUPRI, key NCFB companies such as Boehringer Ingelheim, Fosun Pharma, Expedition Therapeutics, Haisco Pharmaceutical Group, Melodia Therapeutics, Alivexis, and others have also geared up to bring their DPP1 inhibitors to the non-cystic fibrosis bronchiectasis market.

Emerging Non-cystic Fibrosis Bronchiectasis Therapies in Clinical Trials

Key NCFB companies such as Boehringer Ingelheim (Verducatib; BI 1291583), Fosun Pharma/Expedition Therapeutics (XH-S004), Haisco Pharmaceutical Group (HSK31858), and Melodia Therapeutics/Alivexis (MDI-0151) are advancing their DPP1 inhibitors, targeting NCFB, COPD, and related indications. In addition to DPP1 inhibitors like BRINSUPRI, research is exploring other therapeutic classes, including inhaled cell membrane modulators (CMS I-neb; Zambon) and immunomodulators (ARINA-1; Renovion), to address NCFB.

CMS I-neb represents a potential first-in-class inhaled therapy for adults with non-cystic fibrosis bronchiectasis (NCFB) infected with Pseudomonas aeruginosa. Utilizing colistimethate sodium, it targets aerobic Gram-negative pathogens, including drug-resistant strains, by disrupting bacterial cell membranes to reduce and prevent pulmonary exacerbations. The therapy has received Breakthrough Therapy, Qualified Infectious Disease Product, and Fast Track designations from the US FDA, highlighting its potential to address a significant unmet need in this patient population.

In the PROMIS-I trial, CMS I-neb demonstrated a significant reduction in annual pulmonary exacerbation rates among NCFB patients. While PROMIS-II was terminated early due to the COVID-19 pandemic and lack of equipoise following PROMIS-I’s positive outcomes, a sub-analysis of pre-pandemic data confirmed results consistent with PROMIS-I. Zambon now plans to collaborate closely with regulatory authorities to accelerate CMS I-neb’s market approval. The Phase III PROMIS-I and PROMIS-II findings were published in The Lancet Respiratory Medicine in September 2024 and presented at the 6th World Bronchiectasis Conference.

ARINA-1 (RVN-301), under development by Renovion, is an innovative at-home nebulized therapy aimed at improving lung health by clearing mucus, reducing inflammation, and inhibiting bacterial growth. In April 2024, Renovion announced positive topline results from the Phase II CLIMB study of ARINA-1 in NCFB, supporting further development. The company intends to conduct deeper data analyses, engage with regulatory agencies, and progress ARINA-1 into a Phase III program.

Verducatib (BI 1291583) is an innovative inhibitor of dipeptidyl peptidase 1 (DPP1) and cathepsin C (CatC) that has the potential to enhance symptoms and overall quality of life in patients with bronchiectasis. By inhibiting DPP1, verducatib may reduce neutrophilic inflammation, a central factor in bronchiectasis development. This mechanism could help prevent airway damage, improve pathogen clearance, normalize mucus composition, and limit abnormal lung inflammation.

Boehringer Ingelheim is currently evaluating the efficacy, safety, and tolerability of verducatib versus placebo in individuals with bronchiectasis, regardless of underlying causes, through AIRTIVITY [NCT06872892], a Phase III, multicenter, multinational, prospective, randomized, double-blind, placebo-controlled study. The treatment duration ranges from one year to 18 months, with the primary endpoint being the annualized rate of pulmonary exacerbations up to week 76.

The anticipated launch of these emerging NCFB therapies are poised to transform the NCFB market landscape in the coming years. As these cutting-edge NCFB therapies continue to mature and gain regulatory approval, they are expected to reshape the NCFB market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for NCFB, visit @ Non-cystic Fibrosis Bronchiectasis Management

Recent Developments in the Non-cystic Fibrosis Bronchiectasis Market

- In June 2025, Insmed Incorporated announced plans to launch an underwritten public offering of $650 million in common stock. The company also expects to provide underwriters with a 30-day option to purchase up to an additional $97.5 million in shares. All shares in the offering will be issued and sold by Insmed. The completion, size, and terms of the offering remain subject to market conditions and other factors, and there is no guarantee that it will be finalized.

- In May 2025, Insmed presented 11 new abstracts at the American Thoracic Society (ATS) 2025 International Conference, including three prespecified subgroup analyses from the Phase III ASPEN trial evaluating brensocatib in NCFB.

Non-cystic Fibrosis Bronchiectasis Overview

Non-cystic fibrosis bronchiectasis is a long-term lung condition marked by permanent widening of the bronchi, ongoing mucus production, and reduced ability to clear bacteria, which contributes to repeated infections and progressive lung damage. Patients commonly present with a chronic cough and recurrent respiratory infections. Coexisting conditions such as anxiety, depression, and fatigue further diminish quality of life. The disease often results in extended hospital stays and frequent outpatient visits, representing a considerable burden on healthcare systems.

Diagnosis primarily depends on chest CT scans, with additional investigations, such as chest X-rays, bronchoscopy, pulmonary function tests, blood analysis, and sputum cultures, used to identify underlying causes. Because bronchiectasis arises from multiple, complex factors, no single metric can reliably predict disease severity or prognosis.

Non-cystic Fibrosis Bronchiectasis Epidemiology Segmentation

By 2034, the prevalence of non-cystic fibrosis bronchiectasis is expected to rise significantly, driven by improved diagnostic imaging, heightened disease awareness, and aging populations worldwide. The growing burden of chronic respiratory conditions such as COPD and asthma will also contribute to a higher incidence. The non-cystic fibrosis bronchiectasis market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalent Cases of NCFB

- Gender-specific Diagnosed Prevalent Cases of NCFB

- Severity-specific Diagnosed Prevalent Cases of NCFB

- Etiology-specific Diagnosed Prevalent Cases of NCFB

- Microbiology of NCFB Patients

Download the report to understand which factors are driving NCFB epidemiology trends @ Non-cystic Fibrosis Bronchiectasis Treatment Algorithm

| Non-cystic Fibrosis Bronchiectasis Report Metrics | Details |

| Study Period | 2020–2034 |

| Non-cystic Fibrosis Bronchiectasis Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Non-cystic Fibrosis Bronchiectasis Market Size in 2024 | USD 1.5 Billion |

| Key Non-cystic Fibrosis Bronchiectasis Companies | Zambon, Renovion, Haisco Pharmaceutical Group, Chiesi Farmaceutici S.p.A, Armata Pharmaceuticals, Verona Pharma, Sanofi, Regeneron Pharmaceuticals, Boehringer Ingelheim, Chiesi Farmaceutici S.p.A., CSL, Fosun Pharma, Expedition Therapeutics, Melodia Therapeutics, Alivexis, Insmed, AstraZeneca, and others |

| Key Non-cystic Fibrosis Bronchiectasis Therapies in Clinical Trials | Inhaled Colistimethate Sodium (CMS I-neb), ARINA-1 (RVN-301), HSK31858, AP-PA02, Ensifentrine (Nebulizer), Itepekimab, BI 1291583, CHF 6333, CSL787, XH-S004, MDI-0151, BRINSUPRI, and others |

Scope of the Non-cystic Fibrosis Bronchiectasis Market Report

- Non-cystic Fibrosis Bronchiectasis Therapeutic Assessment: Non-cystic Fibrosis Bronchiectasis current marketed and emerging therapies

- Non-cystic Fibrosis Bronchiectasis Market Dynamics: Conjoint Analysis of Emerging Non-cystic Fibrosis Bronchiectasis Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- NCFB Market Unmet Needs, KOL’s views, Analyst’s views, Non-cystic Fibrosis Bronchiectasis Market Access and Reimbursement

Discover more about NCFB drugs in development @ Non-cystic Fibrosis Bronchiectasis Clinical Trials

Table of Contents

| 1 | Key Insights on NCFB Market |

| 2 | Report Introduction |

| 3 | Non-cystic Fibrosis Bronchiectasis Market Overview at a Glance |

| 3.1 | Non-cystic Fibrosis Bronchiectasis Market Share (%) Distribution in 2024 |

| 3.2 | Non-cystic Fibrosis Bronchiectasis Market Share (%) Distribution in 2034 |

| 4 | Epidemiology and Non-cystic Fibrosis Bronchiectasis Market Forecast Methodology |

| 5 | Executive Summary |

| 6 | Key Events |

| 7 | Non-cystic Fibrosis Bronchiectasis Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Etiology and Manifestations |

| 7.3 | Non-cystic Fibrosis Bronchiectasis Symptoms |

| 7.4 | Non-cystic Fibrosis Bronchiectasis Pathophysiology |

| 7.5 | Non-cystic Fibrosis Bronchiectasis Diagnosis |

| 7.5.1 | Non-cystic Fibrosis Bronchiectasis Diagnostic Algorithm |

| 7.5.2 | Non-cystic Fibrosis Bronchiectasis Diagnostic Guidelines |

| 7.6 | Non-cystic Fibrosis Bronchiectasis Prognosis |

| 7.7 | Non-cystic Fibrosis Bronchiectasis Treatment and Management |

| 7.7.1 | Non-cystic Fibrosis Bronchiectasis Treatment Guidelines |

| 8 | Non-cystic Fibrosis Bronchiectasis Patient Journey |

| 9 | Non-cystic Fibrosis Bronchiectasis Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumption and Rationale: The 7MM |

| 9.2.1 | Total Diagnosed Prevalent Cases of NCFB |

| 9.2.2 | Gender-specific Diagnosed Prevalent Cases of NCFB |

| 9.2.3 | Severity-specific Diagnosed Prevalent Cases of NCFB |

| 9.2.4 | Etiology-specific Diagnosed Prevalent Cases of NCFB |

| 9.2.5 | Microbiology of NCFB Patients |

| 9.3 | Total Diagnosed Prevalent Cases of NCFB in the 7MM |

| 9.4 | The US |

| 9.5 | EU4 and the UK |

| 9.6 | Japan |

| 10 | Non-cystic Fibrosis Bronchiectasis Marketed Drugs |

| 10.1 | Key Cross Competition |

| 10.2 | BRINSUPRI (Brensocatib): Insmed/AstraZeneca |

| 10.2.1 | Drug Description |

| 10.2.2 | Other Developmental Activities |

| 10.2.3 | Clinical Trials Information |

| 10.2.4 | Safety and Efficacy |

| 10.2.5 | Analysts' View |

| 11 | Non-cystic Fibrosis Bronchiectasis Emerging Drugs |

| 11.1 | Key Cross Competition |

| 11.2 | Inhaled Colistimethate Sodium (CMS I-neb): Zambon |

| 11.2.1 | Drug Description |

| 11.2.2 | Other Developmental Activities |

| 11.2.3 | Clinical Trials Information |

| 11.2.4 | Safety and Efficacy |

| 11.2.5 | Analysts' View |

| 11.4 | ARINA-1 (RVN-301): Renovion |

| 11.5 | HSK31858: Haisco Pharmaceutical Group/Chiesi Farmaceutici S.p.A |

| 11.6 | AP-PA02: Armata Pharmaceuticals |

| 11.7 | Ensifentrine (Nebulizer): Verona Pharma |

| 11.8 | Itepekimab: Sanofi/Regeneron Pharmaceuticals |

| 11.9 | BI 1291583: Boehringer Ingelheim |

| 11.10 | CHF 6333: Chiesi Farmaceutici S.p.A. |

| 11.11 | CSL787: CSL |

| To be continued in the final report. | |

| 12 | Non-cystic Fibrosis Bronchiectasis: The 7MM Analysis |

| 12.1 | Key Findings |

| 12.2 | Key Non-cystic Fibrosis Bronchiectasis Market Forecast Assumptions |

| 12.2.1 | Cost Assumptions and Rebates |

| 12.2.2 | Pricing Trends |

| 12.2.3 | Analogue Assessment |

| 12.2.4 | Launch Year and NCFB Therapy Uptake |

| 12.3 | Non-cystic Fibrosis Bronchiectasis Market Outlook |

| 12.4 | Attribute Analysis |

| 12.5 | Total Non-cystic Fibrosis Bronchiectasis Market Size in the 7MM |

| 12.6 | Total Non-cystic Fibrosis Bronchiectasis Market Size by Therapies in the 7MM |

| 12.7 | Non-cystic Fibrosis Bronchiectasis Market Size in the US |

| 12.7.1 | Total Non-cystic Fibrosis Bronchiectasis Market Size in the US |

| 12.7.2 | The Non-cystic Fibrosis Bronchiectasis Market Size by Therapies in the US |

| 12.8 | Non-cystic Fibrosis Bronchiectasis Market Size in EU4 and the UK |

| 12.9 | Non-cystic Fibrosis Bronchiectasis Market Size in Japan |

| 13 | Key Opinion Leaders’ Views |

| 14 | Non-cystic Fibrosis Bronchiectasis Market SWOT Analysis |

| 15 | Non-cystic Fibrosis Bronchiectasis Market Unmet Needs |

| 16 | Non-cystic Fibrosis Bronchiectasis Market Access and Reimbursement |

| 16.1 | The US |

| 16.2 | In EU4 and the UK |

| 16.3 | Japan |

| 17 | Acronyms and Abbreviations |

| 18 | Bibliography |

| 19 | Non-cystic Fibrosis Bronchiectasis Market Report Methodology |

Related Reports

Dipeptidyl Peptidase 1 (DPP1)/Cathepsin C Inhibitor Market

Dipeptidyl Peptidase 1 (DPP1)/Cathepsin C Inhibitor Target Population, Competitive Landscape, and Market Forecast – 2034 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key DPP1/CatC inhibitor companies, including Insmed Incorporated, Boehringer Ingelheim, Shanghai Fosun Pharmaceutical, Expedition Therapeutics, Melodia Therapeutics, Alivexis, among others.

Non-cystic Fibrosis Bronchiectasis Pipeline

Non-cystic Fibrosis Bronchiectasis Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key NCFB companies, including Zambon SpA, Insmed, Armata Pharmaceuticals, Verona Pharma, Haisco Pharmaceutical Group, Infex Therapeutics, Boehringer Ingelheim, Regeneron Pharmaceuticals, Sanofi, Renovion, 30 TECHNOLOGY, Arrowhead Pharmaceuticals, Spexis, AstraZeneca, CSL Behring, Spexis, NovaBiotics, Alveolus Bio, SpliSense, Parion Sciences, Vast Therapeutics, among others.

Cystic Fibrosis Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key cystic fibrosis companies, including Verona Pharmaceuticals, Laurent Pharmaceuticals Inc., Vertex Pharmaceuticals, SpliSense Ltd., Krystal Biotech, Inc., Aridis Pharmaceuticals, Inc., 4D Molecular Therapeutics, Sound Pharmaceuticals, Incorporated, Clarametyx Biosciences, Inc., BiomX, Inc., Boehringer Ingelheim, Respirion Pharmaceuticals Pty Ltd, Anagram Therapeutics, Inc., among others.

Cystic Fibrosis Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key cystic fibrosis companies, including Krystal Biotech, Vertex Pharmaceuticals, Translate Bio, Novartis, Algi Pharma, Verona Pharma, Atlantic Healthcare, Calithera Biosciences, Horizon Therapeutics, Santhera Pharmaceuticals, Reveragen Biopharma, Spli Sense, GlaxoSmithKline, EmphyCorp, Abbvie, Galapagos NV, Vertex Pharmaceuticals, PathBio Analytics, AstraZeneca, Axentis Pharma AG, among others.

Bronchiectasis Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key bronchiectasis companies, including Insmed, AstraZeneca, Zambon, Renovion, Haisco Pharmaceutical Group, Chiesi Farmaceutici S.p.A, Armata Pharmaceuticals, Verona Pharma, Sanofi, Regeneron Pharmaceuticals, Boehringer Ingelheim, CSL, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.