Guadalupe County Appeals Build on Residential Value Decline and Slow Commercial Value Increase

O'Connor discusses how Guadalupe County appeals built on residential value decline and slowed commercial value increases.

SEGUIN, TX, UNITED STATES, November 3, 2025 /EINPresswire.com/ --Along with Comal and Bexar, Guadalupe County forms the core of the greater San Antonio area. A key part of the Texas Triangle, Guadalupe County is a historic area that has been important for the Texas economy and culture for over a hundred years. Much like San Antonio itself, the county is diverse, with many different cultures, businesses, and towns. While Seguin is the main city, there are plenty of smaller settlements and towns that make up the county.

Guadalupe County bucked a major trend in 2025. Most Texas counties, especially prominent ones, saw major increases in property values. While Guadalupe County saw some, they also managed to experience the rare property value decrease. This slowing opens things up for property tax appeals, which can lower things even further, possibly going to levels from before 2024. They also help shield taxpayers against future hikes, which are surely coming. In this article, we will see how informal and formal appeals were able to benefit the taxpayers of the county and how this was able to turn the tide against price hikes.

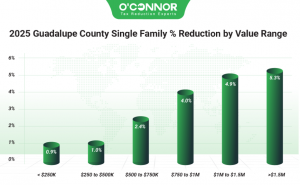

Home Protests Pile 1.6% Reduction on Top of Assessed Decrease

In 2024, the Guadalupe Appraisal District (GCAD) assessed residential property as having gained 5.6% in taxable value. This was reversed in 2025 when GCAD declared that home values had dropped 0.2%, though they believed that 52% of all homes were overvalued. Despite the small downturn, many homeowners smartly protested their taxes. This led to an overall decrease of 1.4%, which brought the final total to $21.37 billion. Most value came from homes worth between $250,000 and $500,000, totaling $12.81 billion after a decrease of 1%. While netting an appellant cut of 0.9%, homes worth under $250,000 fell to $3.59 billion. Homes worth between $500,000 and $750,000 were reduced by 2.4% to $2.34 billion. Homes worth over $1.5 million were surprisingly high in both value and in their reduction, dropping 5.3% to $1.05 billion. Clients that used O’Connor for their appeals saw an overall culling of 4.9%.

Guadalupe County homes tend to be a little larger than the Texas average. Homes between 2,000 and 3,999 square feet had a combined value of $11.39 billion, even after being shaved down by 1.5%. Homes under 2,000 square feet were in the No. 2 slot with $8.41 billion after a cut of 1.5%. Those from 4,000 to 5,999 square feet decreased 5.5% to $473.25 million. Matching the previous graph, the largest homes experienced the biggest reduction with 14.4%, which translated into a final tally of $37.62 million.

When looked at by age of construction, Guadalupe County has a strong recency bias. Like most Texas counties, the largest source of value was homes built from 2001 to 2020, totaling $10.16 billion after a drop of 1.3%. $3.77 billion came from homes constructed from 1981 to 2000, which was after a trimming of 1.8%. The key difference was new construction. While most timeframes saw assessed decreases, new construction instead increased 28.2%. While this was eventually slowed by 1.5%, new construction still saw a grand total of $3.59 billion. If it was not for the meteoric rise of new construction, the overall value decrease would have been much higher.

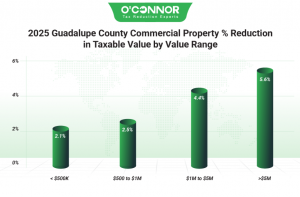

Taxpayers Capitalize on Small Hike with Large Protest Reductions

While commercial properties did not get handed a decrease from GCAD, they did see a small bump of 1.7%, under what most counties had experienced. Business owners used this opportunity to launch solid appeals, bringing in further savings of 4.1%. This resulted in a final total of $6.75 billion. This was most keenly felt by commercial properties worth over $5 million, which dropped 5.6% to $2.22 billion. Only these were not the most valuable business properties. That honor went to real estate worth between $1 million and $5 million, which fell 4.4% to $2.27 billion. Businesses worth less than $250,000 and those assessed at between $500,000 and $1 million were cut 2.1% and 2.5% respectively. We at O’Connor were able to land a bonanza of savings for our business clients, bringing home a total reduction of 13.8%.

The largest reservoir of value in commercial property came from raw land. This is common in counties that are becoming more urban, as land becomes higher in demand. Totaling $4.60 billion, raw land saw a reduction of 2.9% thanks to appeals. Land had previously been assessed as declining by 4%, providing some key savings out of the gate. The initial decline in land swayed the overall total drastically, hiding that most other categories increased 10% or more. Warehouses were the second largest when it came to value, reaching $1.04 billion after a reduction of 5.2%. Apartments were in the No.3 slot with a savings of 9.2% and a total of $454.88 million. Offices and retail fell 6.3% and 7% respectively.

Recent construction had a similar weight in business properties as it did for homes. The “other” category, representing raw land, was No. 1, but actual developed properties followed the previous model. Properties built from 2001 to 2020 accounted for $1.04 billion in value after a significant cut of 7% thanks to appeals. Construction from 1981 to 2000 added $448.44 million following a reduction of 6.8%. New construction once again shot up dramatically, this time jumping 58.4% in value. These new business properties were eventually slashed by 5% to $4.22 million.

Apartments Slice 9.2% from Taxable Value

Apartments were initially handed an assessed increase of 31% from GCAD, though this was quickly countered with a flurry of appeals that managed to slash 9.2% from the total, resulting in a final tally of $454.88 million. Owing to the increasing urbanization of the county, apartments have some of the most pronounced recency bias out of all commercial properties. Apartments built from 2001 to 2020 accounted for 40.6% of all value, which translated to $184.51 million following a reduction of 10%. New construction was responsible for $177.11 million in value, seeing a cut of 6.1%. New construction had previously added 51.3% to its value. We at O’Connor focused hard on apartments, bringing our clients an overall reduction of 27%.

GCAD only categorized apartments into two types. Generic apartments got the lion’s share of value at $447.76 m, which was achieved after a reduction of 9.2%. Garden apartments fell 6.8% to $7.11 million.

Appeals Slow Growth from New Office Construction

GCAD started 2025 by increasing the value of offices by 13.8%, for a grand total of $373.49 million. This was eventually counterbalanced by informal and formal protests, resulting in a cut of 6.3%, creating a new total of $349.89 million. 42.5% of office value was built between 2001 and 2020, accounting for $149.89 million after a solid reduction of 7.5%. Those built between 1981 and 2000 experienced a drop of 6.2%, achieving a total of $74.76 million. Initially adding 35.2%, new construction was stymied somewhat thanks to a reduction of 6.2%. This meant that new offices totaled around $63.10 million. O’Connor clients were able to beat the county average, landing an overall reduction of 8.2%.

There were only two types of offices according to GCAD. Low-rise office buildings managed a reduction of 5.6%, falling to $227.02 million. Medical offices cut 7.7% from their total, going to $122.88 million.

Warehouses Land Key Reductions

Outside of raw land, warehouses were the largest type of commercial property in Guadalupe County. This is common for urban areas outside of major cities. Warehouses originally saw an increase of 11.9%, though this was met with a strong appeal campaign, resulting in a drop of 5.2%. This took the final tally from $1.10 billion to $1.04 billion. The construction pattern closely followed the previous examples, with $511.85 million coming from warehouses built between 2001 and 2020. These warehouses eventually saw a reduction of 5.2%. Those built from 1981 to 2000 decreased 5.8%, falling to $273.83 million. New construction was again a rising star, adding 45.3%, raising its total to $161.84 million. This was eventually cut back 3.5% to $161.84 million. Thanks to their importance, we at O’Connor were laser-focused on warehouses, eventually landing our clients an overall cut of 14.8%.

There were only three types of warehouses according to GCAD. Generic warehouses ruled the roost with a reduction of 5.5%, totaling $844.90 million. Mini warehouses fell 4.5% to $170.47 million, while office warehouses achieved a total of $24.65 million with no reduction.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.